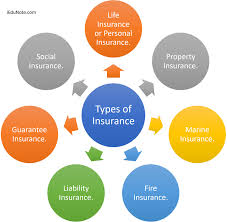

Insurance is a vital protection for individuals and businesses, providing financial security against unforeseen events.

With numerous types of insurance policies available, it can be overwhelming to choose the right one. In this article, we will explore the various types of insurance, their benefits, and how they can help mitigate risks.

1. _Life Insurance_

Life insurance provides financial support to beneficiaries in the event of the policyholder’s death. It can help pay for funeral expenses, outstanding debts, and ongoing living costs. There are two main types of life insurance:

– _Term Life Insurance_: Covers the policyholder for a specified period (e.g., 10, 20, or 30 years).

– _Whole Life Insurance_: Provides lifetime coverage, as long as premiums are pa

1. _Health Insurance_

Health insurance covers medical expenses, including hospital stays, surgeries, and doctor visits. It can help alleviate financial burdens and ensure access to necessary medical care. Types of health insurance include:

– _Individual Health Insurance_: Covers a single person.

– _Group Health Insurance_: Covers a group of people, often through an employer.

– _Family Health Insurance_: Covers multiple family members.

1. _Auto Insurance_

Auto insurance protects against financial losses due to vehicle damage or theft, and provides liability coverage in case of accidents. Types of auto insurance include:

– _Liability Insurance_: Covers damages to others in an accident.

– _Collision Insurance_: Covers damages to the policyholder’s vehicle.

– _Comprehensive Insurance_: Covers damages due to non-accident events (e.g., theft, vandalism).

1. _Home Insurance_

Home insurance covers damage or loss of a home and its contents due to natural disasters, theft, or other events. Types of home insurance include:

– _Homeowners Insurance_: Covers the home and its contents.

– _Renters Insurance_: Covers a renter’s personal belongings.

– _Flood Insurance_: Covers damages due to flooding.

1. _Travel Insurance_

Travel insurance provides financial protection against trip cancellations, medical emergencies, and lost or stolen luggage while traveling. Types of travel insurance include:

– _Trip Cancellation Insurance_: Covers trip cancellations due to unforeseen events.

– _Travel Medical Insurance_: Covers medical expenses while traveling.

– _Travel Delay Insurance_: Covers delays due to unforeseen events.

1. _Disability Insurance_

Disability insurance replaces income if the policyholder becomes unable to work due to illness or injury. Types of disability insurance include:

– _Short-term Disability Insurance_: Covers a short period (e.g., 90 days).

– _Long-term Disability Insurance_: Covers an extended period (e.g., several years).

1. _Liability Insurance_

Liability insurance protects against financial losses due to lawsuits or other legal claims. Types of liability insurance include:

– _Personal Liability Insurance_: Covers individuals against lawsuits.

– _Professional Liability Insurance_: Covers professionals (e.g., doctors, lawyers) against lawsuits.

– _Product Liability Insurance_: Covers businesses against lawsuits related to products.

1. _Business Insurance_

Business insurance covers businesses against financial losses due to property damage, liability, or other events. Types of business insurance include:

– _Property Insurance_: Covers business property against damage or loss.

– _Liability Insurance_: Covers businesses against lawsuits.

– _Workers’ Compensation Insurance_: Covers employee injuries or illnesses.

1. _Long-term Care Insurance_

Long-term care insurance provides financial support for long-term care services, such as nursing home care or in-home care. Types of long-term care insurance include:

– _Traditional Long-term Care Insurance_: Covers long-term care services.

– _Hybrid Long-term Care Insurance_: Combines life insurance with long-term care coverage.

1. _Umbrella Insurance_

Umbrella insurance provides additional liability coverage beyond what is offered by other insurance policies. It can help protect assets in case of a lawsuit.

In conclusion, insurance is a vital protection for individuals and businesses, providing financial security against unforeseen events. By understanding the various types of insurance, you can choose the policies that best suit your needs and mitigate risks. Remember to carefully review policy terms and conditions, and consult with a licensed insurance professional if needed.